O2 Technologies has been a trusted IT solutions provider for banks, fintech companies, and financial institutions, enabling them to improve efficiency, security, compliance, and customer engagement. Below are real-world scenarios demonstrating how O2 Technologies has benefited its clients.

At O2 Technologies, we possess deep expertise in delivering IT solutions tailored to the unique needs of the BFSI sector. With a focus on security, automation, and compliance, we provide advanced fraud detection and prevention systems using AI and machine learning, helping safeguard against financial crimes. Our solutions also span digital banking, cloud services, blockchain payment systems, and core banking operations, optimizing efficiency and customer experience. We empower BFSI institutions to meet regulatory requirements, enhance data-driven decision-making, and mitigate risks, ensuring agility and innovation in a rapidly evolving industry.

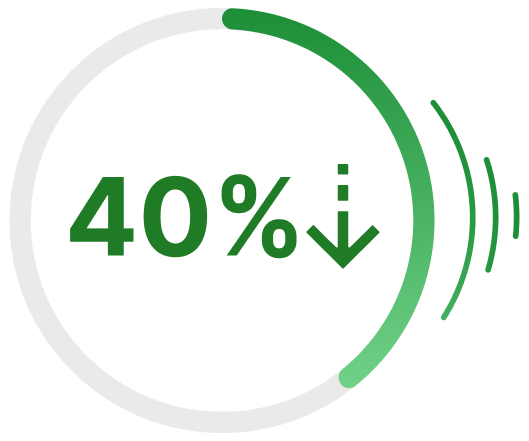

Client Challenge: A major banking institution faced frequent cyber threats and fraud attempts.

O2 Tech Solution: Implemented AI-powered fraud detection and threat monitoring using machine learning to analyze transaction patterns in real-time.

Impact: Reduced fraudulent transactions by 40% and improved compliance with AML/KYC regulations.

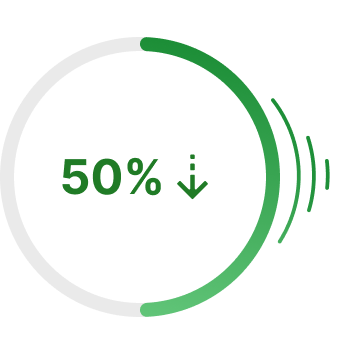

Client Challenge: A leading retail bank relied heavily on manual processes for loan processing, reconciliation, and reporting — increasing operational costs and turnaround times.

O2 Tech Solution: Implemented intelligent process automation using AI-driven bots to handle repetitive back-office tasks such as loan verification, KYC processing, and data entry — reducing human intervention.

Impact: Achieved 50% reduction in operational costs, improved accuracy in compliance reports, and accelerated processing time for retail banking services.

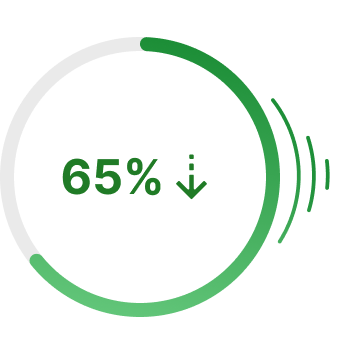

Client Challenge: A leading financial institution faced declining customer satisfaction due to long response times, manual service handling, and inconsistent support across digital channels.

O2 Tech Solution: Introduced an AI-driven customer engagement platform integrating chatbots, automated service routing, and predictive analytics to personalize user experiences and resolve queries faster.

Impact: Reduced customer response time by 65%, increased satisfaction scores by 40%, and improved operational efficiency across service centers.

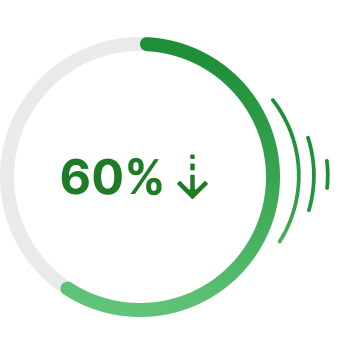

Client Challenge: A multinational enterprise faced continuous cyber threats, including phishing, ransomware, and data breaches, compromising sensitive customer information.

O2 Tech Solution: Implemented a centralized security monitoring platform integrating AI-driven threat detection, automated incident response, and vulnerability assessment tools.

Impact: Reduced cybersecurity incidents by 60%, improved breach detection speed, and enhanced compliance with data protection regulations.

From digital platforms to enterprise software, we turn ideas into future-ready solutions.

This is another card content example.

Additional content goes here.

Extra card content.