Bitcoin was worth less than a cent in March 2010. A little over ten years later, each Bitcoin was worth about USD 20,000, and early adopters were driving Lamborghinis. Furthermore, despite the fact that the enthusiasm surrounding Bitcoin will always be inextricably linked to its price, the cryptocurrency’s widespread use has thrust blockchain—the technology that protects it—into the tech limelight. The demand for blockchain expertise increased by about 2,000 percent between 2017 and 2020, making it one of the most in-demand skills globally.

Describe blockchain

Blockchain is a shared, unchangeable database that makes it easier to record transactions and track assets in a corporate network, according to Blockchain for Dummies. Intellectual property, patents, copy rights, and branding are examples of intangible assets. Tangible assets include houses, cars, and cash-valued land. On a blockchain network, practically anything of value may be recorded and sold, lowering risk and expenses for all parties. A blockchain network can be created in a number of ways: it can be made public so that anyone can join, private so that just one organisation controls it, permissioned so that users must first receive an invitation or permission before joining, or it can be created and maintained by a group of organisations.

A brief description of blockchain

A blockchain, in its most basic form, is a digital database of transactional data. Because of this, the term “ledger” is frequently used to describe blockchain technology. A method based on chaining together blocks of data is used to store numerous different collections of data together. Each block is connected to those surrounding it via chains, so they communicate with one another. As a result, if a block is changed, a nearby block will detect the issue right away and stop the invalid transaction. As a result, transactions on the blockchain are irrevocable, providing a shared permanent record for all users. The blockchain has the power to transform the way we think about, use, and legitimise a wide range of agreements, contracts, and technology.

The Origin of The Blockchain

Most people think of the blockchain when they consider well-known technology like Bitcoin. Blockchain technology is independent of Bitcoin, yet the cryptocurrency powerhouse fuelled its development and remains a key player in the blockchain movement. However, the blockchain did not initially relate to money. The idea of a blockchain was developed in 1991 as a means of employing an immutable time stamp to validate the contents of a document. The blockchain was created as a mechanism to authenticate the contents of a document and date and time stamp the verification without disclosing what is inside. This gave blockchain transactions secrecy, validity, and immutability.

Blockchain’s distributed ledger

A ledger is a record of transactions that includes crucial information including the occasion, parties, nature of the transaction, and any applicable sums. A chequebook, which lists the dates, amounts, and recipients of checks as well as how much money is still in your checking account, is a typical illustration of a ledger. However, if you conduct the majority of your banking online, your monthly bank statement doubles as a ledger.

On the blockchain, the ledger is referred to as “distributed,” which implies that updates are made and shared with everyone on the network. The ledger is shared across numerous users or peers in this manner. The complete ledger is available to each peer.

The decentralised nature of the blockchain

The blockchain is decentralised because no one entity or organisation has authority over it and everyone has access to the same ledger. Due to banks’ control over transactions, the blockchain differs from other financial organisations like banks in this regard.

Here’s an illustration: Imagine that traditional banks are like outdated versions of Microsoft Word and the blockchain is like Google Docs. Anyone with access to the document can make changes using Google Docs. The only thing you can do with Microsoft Word, on the other hand, is send a saved file for someone else to read. Unlike banks, which only give out statements, anyone connected to the blockchain can add to the ledger. Because it is centralised, you cannot add a transaction to the bank’s ledger or carry out a transaction without its consent.

How the blockchain prevents tampering

The Google Docs parallels end with the blockchain’s immutable, or unchangeable, character. Nobody can alter what has been entered into the blockchain, unlike Google Docs. On the network, each peer can only add transactions. In other words, nothing added so far can be changed in any way.

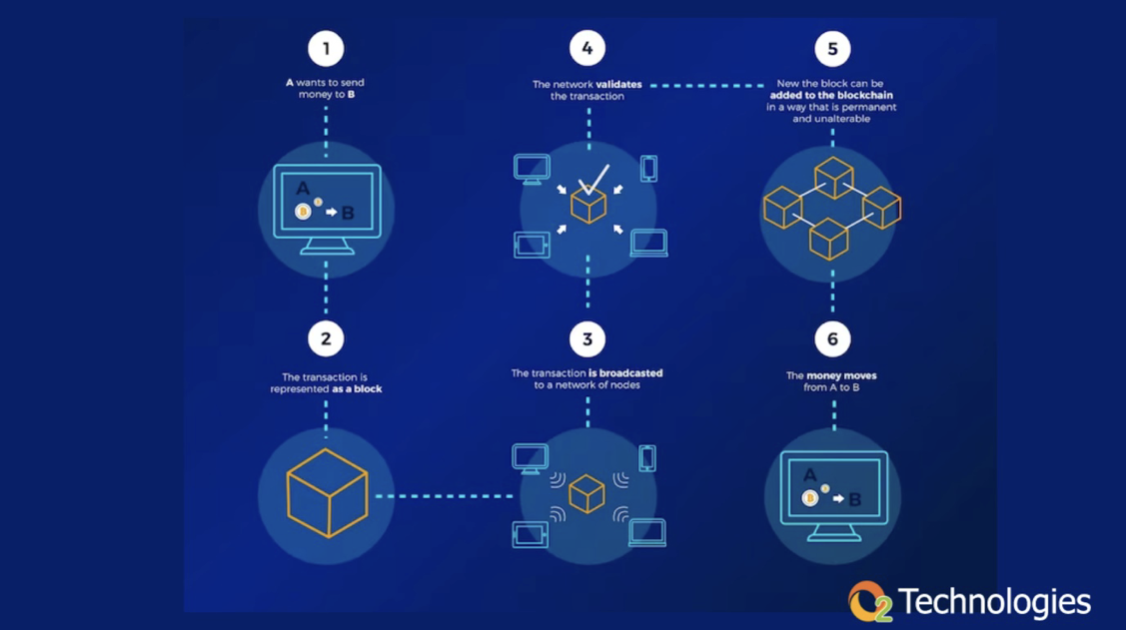

Workings of the blockchain

Public and consortium blockchains are just two examples of the many distinct types of blockchains, but they all share some fundamental components. Blocks make comprise a blockchain. Data is contained in these blocks. The information in the data must be recorded on the blockchain’s ledger.

For instance, the statistics for bitcoin includes:

- Sender

- Receiver

- What amount of money is being sent

Food tracking uses blockchain technology as well. In this instance, the block would include information like:

- where the produce was grown

- The facility that handled it

- The place the food was bought

If there is a food-borne illness, you can easily determine where the product was manufactured and which facilities (or even individuals) handled it thanks to the blockchain. Within minutes or hours, you can use that knowledge to prevent others from contracting the infection. If the auto industry adopted blockchain technology, you could guarantee the accuracy of odometer readings for vehicles, prohibiting anyone from tampering with them to alter their worth.

The block may, for instance, include a precise odometer reading and the date it was taken. Anyone with access to the blockchain would be able to view a genuine record of how far the car had actually been driven.

Why is it impossible to alter data on a blockchain?

Why can’t the data be modified, you might be asking yourself. Of course, it is possible; simply modify it! It’s not just you. The answer is crucial because this is a frequently asked issue. Every piece of information stored in a blockchain block has a hash value. This number is created by running some data through a formula; the algorithm’s output is referred to as a hash. The hash is often a string of characters, and no matter how much data you pass into a particular formula, the hashes it produces are always the same length.

For instance, hashes generated by the MD5 formula are always 32 characters long. You will always get a hash result that is 32 characters long, whether you enter the formula with only the letter C or the complete word Codecademy. Additionally, the method always yields the exact same hash for a given set of data. As a result, the string for Codecademy always yields the number e2f38549c5d471e64f7c16cf44d2d36d when employing the MD5 formula. (Try it out for yourself.)

This is significant since each block’s hash acts as its individual digital fingerprint. For a particular piece of data, a checksum that confirms the accuracy of the data is also generated along with the hash value. This provides defence against unauthorised modifications, data transmission failures, and hackers. Only when the checksums produced for each file using the same cryptographic hash function are identical can two files be deemed to be identical.

Cryptographic hash functions require four characteristics in order to be helpful. They must be:

- Computerised effectiveness

- Deterministic

- resistive to pre-image

- Collision-resistant

Here is more information on each of these attributes:

The decentralised nature of the blockchain

It’s time to use NoSQL to help your business flourish. Despite their potential for great power, NoSQL databases are not suited for taking the place of SQL. In actuality, they are designed to cooperate with and enhance SQL databases. Contact the experts at O2 Technologies if you require any help with creating, building, or integrating a NoSQL database into your analytics or development environment.

Computerised effectiveness

Computers can swiftly perform the hash functions thanks to computational efficiency. As a result, a computer can carry out the task without using a lot of computing resources. The entire performance of the blockchain is improved by this increased power.

Deterministic

Because the blockchain is deterministic, the hash function will always provide the same output for any given input. For instance, the hash function must always provide the same output if the same input is entered repeatedly, even if it is entered at different times. This is comparable to the operation of a typical mathematical function. For instance, if you change X to 3 in the equation X + 2 = Y, Y will always be 5 or 3 plus 2.

Resistive to pre-image

Pre-image resistance in a hash function refers to the property that the output does not reveal any information about the input. Therefore, even if you are aware of the result, you are unable to determine the input that led to it. Thus, the pre-image resistance of cryptographic hashes safeguards the anonymity of users using the blockchain for transactions. The input for cryptographic hash functions can range from integers to letters to phrases to paragraphs to whole novels. No matter how large or tiny the input is, the function by itself says nothing about it.

Collision-resistant

It is practically difficult for two different inputs to result in the same output when a hash is collision-resistant. While the input to a hash can be of any size, the output is set in length. Therefore, there is a very small chance that the output will be the same given two different inputs.

Common hashing operations

The two hash algorithms that are most frequently utilised for data authentication are MD5 and SHA-2.

(Message-Digest algorithm, version 5)

You presumably already know that the MD5 hash function is regarded as cryptographically flawed if you’ve heard of it. However, despite its serious flaws, it is frequently employed as a checksum to confirm the accuracy of data. It generates a 128-bit hash value and is employed in numerous different security-related applications.

SHA-2

The SHA-2 family of hash algorithms was created by the National Security Agency of the United States. The SHA-256 hash, which is utilised by Bitcoin, is one of them. The hash value returned by SHA-2 is 256 bits, and it is thought to be a lot more secure than MD5.

The hash pointer is the secret to the immutability of the blockchain

In the blockchain, each block of data carries a pointer to the block that came before it, and the block after it points to the block before it. The first block, often known as Block 0 or the genesis block, is the only exception. The genesis block lacks a previous block to point to since it serves as the base upon which subsequent blocks are built to create a chain. Consequently, a genesis block’s “previous hash” value is set to 0. This merely indicates that there was no processing of data prior to the genesis block. Following the genesis block, each block has a sequential number starting at 1 and a “previous hash” setting that is set to the hash of the block before it. As a result, it is possible to trace each block back to the one that came before it, the one before that, and so on, all the way to the genesis block.

The hash function applied to the data yields the value of each block. As a result, if the data is changed or altered, the block’s generated hash value will also change. This marks the information as invalid on the blockchain, keeping the transaction secure. For instance, if a blockchain contains three blocks, the second block will point to the first, and the third block will point to the second. Because the hash function is deterministic and collision-resistant, if someone tries to change the data in the second block, they would also change the hash value the block generates. Since the third block’s pointer is seeking for the first hash result, it would no longer function. As a result, the blockchain’s results start to falter, exposing the attempted tampering.

The pointer functions as a kind of digital contract between blocks in a blockchain, rendering the data in transactions like money transfers, odometer readings, and the location of vegetable farms immutable or unchangeable. One of the key benefits of blockchain technology is the high level of security it offers.

The blockchain’s four characteristics

Every blockchain shares these fundamental characteristics:

Peer-to-peer: No single entity or organisation has control over the blockchain. All users on the network are equal players who communicate with one another directly and without the use of any intermediaries.

Distributed: It is very hard to tamper with the ledger because it is dispersed across the entire network. Controlling at least 51% of the machines connected to the blockchain network would be the only way to potentially change the ledger.

Cryptographically secured: Cryptography is employed to provide security and renders the ledger impenetrable to tampering. Thanks to cryptography, it is impossible to determine the data that was entered from the output.

Add-only: Data can only be added to the blockchain, and each entry’s time stamp further increases the immutability of the blockchain.

Blockchain Roadblocks

Although blockchain technology is revolutionary and very practical in many ways, there are also big barriers to overcome.

Education

Many businesses avoid using blockchain technology because they lack the necessary expertise to execute it. Because blockchain is a relatively new technology, many people are unsure of how to utilise it or how it functions. The widespread adoption of the blockchain is being slowed down by this. Despite uneven acceptance, a number of businesses are currently employing blockchain technology successfully. Spring Labs is one business utilising the data ledger technology and openness of the blockchain. They use on the built-in security provided by blockchain technologies to provide organisations with a mechanism to move information more quickly and securely. The rate at which individuals adopt the blockchain into their daily lives and corporate systems can be greatly influenced by educating the public about how to use it and why it’s such a powerful tool.

Governments and banks oppose decentralisation

Users can communicate directly with one another via the blockchain, which reduces the influence and profit potential that banks now have in the current financial system. For instance, you can instantly give someone thousands of dollars via the blockchain without having to pay a bank any fees. If everyone used blockchain transactions, banks would be unable to charge the same wiring or transfer fees that they currently do. The identification of those receiving or sending money, as well as other interactions like confirming the location of food’s origin, are all things that governments wish to have control over. The participants in a transaction are never identified thanks to the blockchain. This makes it reasonably simple for users to maintain their anonymity when carrying out a variety of contractual responsibilities and sending and receiving money.

Usability and simplicity

Despite the fact that Bitcoin and other cryptocurrencies can be used to make purchases of goods and services, due to its limited popularity, Bitcoin is more like gold in that it is primarily used as a form of value storage. Although Bitcoin is undoubtedly the most well-known cryptocurrency, using Bitcoin to make a transaction is much more time-consuming than using a credit card. Because of this, some people are apprehensive to use it as their primary form of payment.

Technology

The adoption of blockchain solutions is also hampered by technological constraints. Some blockchains’ architectures provide a bottleneck as the volume of transactions increases. The number of transactions allowed on the Bitcoin network was initially capped at seven per second. When compared to, say, the Visa network, which can finish thousands of transactions in the same period of time, this is noticeably low.

Blockchain technology’s future

People from all over the world may instantaneously conduct business transactions and exchange, collect, and analyse data thanks to the blockchain. People must first learn how the blockchain operates before they can modify it to carry out routine chores and create new opportunities. Because blockchain solutions offer quick, safe means to transfer and receive money, certain banks and financial organisations are already using and developing them.

Smart contracts are one of the most adaptable uses for the blockchain. These are agreements that two or more parties might reach regarding the terms of a sale, much like you would write them down on paper. The transaction can proceed once all conditions of the contract have been met. A smart contract, for instance, may be used to speed up the sale of a home. The smart contract can contain rules for everything from liens to home inspections.

Blockchain can be used for further real estate transactions as well. The transaction would be as simple and affordable if someone from the US wanted to buy land in Jamaica while they were in France as it would be if they were in Jamaica. These kinds of transactions will become increasingly typical as more financial institutions use blockchain technology. The decentralised finance movement, sometimes known as Defi, is a significant role in the future of the blockchain. Simply put, Defi is cryptocurrency-based financing. Users of Defi systems can lend and borrow money, with the lenders receiving interest on the funds they make available for borrowing.

The benefits and drawbacks of adopting blockchain

The use of the blockchain has benefits and drawbacks, just like any other technology. Consider the following advantages and disadvantages:

Blockchain technology has gained significant attention in recent years due to its potential to disrupt various industries. While it offers numerous benefits, it also comes with certain drawbacks and challenges. Let’s explore both sides of adopting blockchain technology:

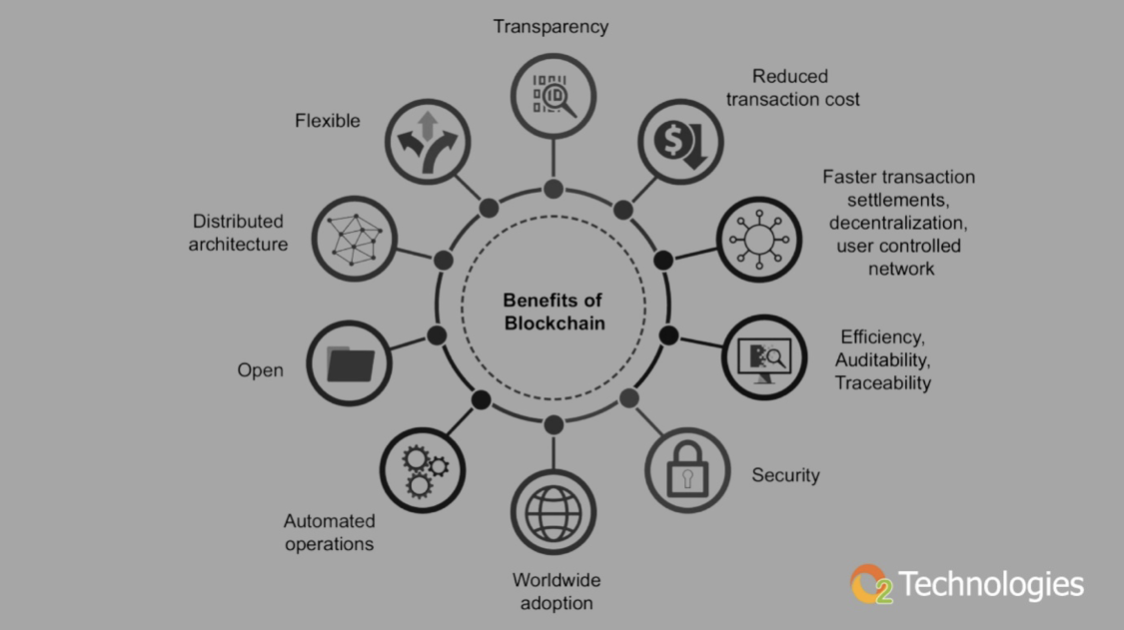

Benefits of Adopting Blockchain:

Transparency and Immutability: Blockchain is a decentralized ledger that records transactions across a network of computers. A transaction cannot be changed or removed after it has been added to the blockchain. This immutability ensures trust and transparency in the system, making it resistant to fraud and manipulation.

Security: To protect data, blockchain uses cutting-edge cryptography methods. Transactions are linked together in a chain, and consensus mechanisms ensure that only valid transactions are added to the ledger. This makes it extremely difficult for malicious actors to compromise the network.

Reduced Intermediaries: Blockchain eliminates the need for intermediaries like banks, clearinghouses, or notaries in various processes, reducing costs and speeding up transactions. This disintermediation can lead to more efficient and cost-effective operations.

Increased Efficiency: Smart contracts, self-executing contracts with the terms of the agreement directly written into code, automate processes and reduce the need for manual intervention. This can lead to faster execution of agreements and lower administrative costs.

Global Accessibility: Blockchain operates on a global scale, accessible to anyone with an internet connection. This opens up new opportunities for financial inclusion and cross-border transactions without the need for traditional banking systems.

Supply Chain Transparency: Blockchain enables end-to-end visibility in supply chains. Companies can trace the origins of products, ensuring authenticity and sustainability. This transparency enhances trust among consumers and reduces the risk of fraud.

Tokenization of Assets: Blockchain allows for the tokenization of assets, making it easier to divide ownership, trade, and invest in traditionally illiquid assets like real estate and art. This democratizes access to investments.

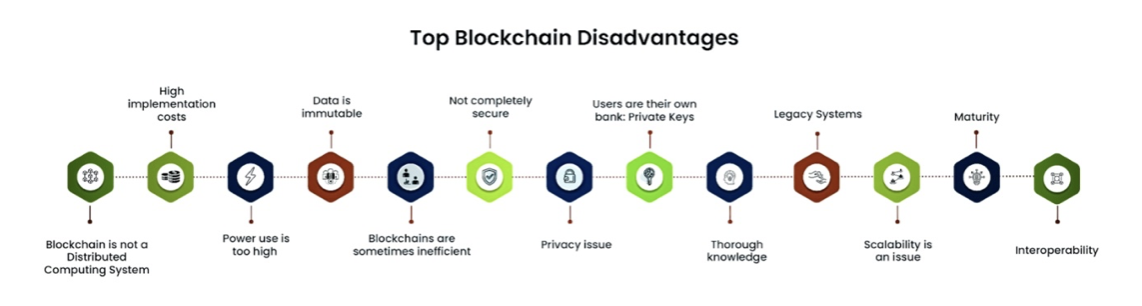

Drawbacks and Challenges of Adopting Blockchain:

Scalability: Many blockchain networks struggle with scalability, resulting in slower transaction speeds and higher fees during peak usage. Solving scalability issues is a significant challenge for widespread adoption.

Regulatory Uncertainty: The regulatory environment for blockchain and cryptocurrencies varies widely from country to country. Navigating these regulations can be complex, and changes in regulation can impact blockchain projects significantly.

Energy Consumption: Some blockchain networks, especially those using proof-of-work consensus mechanisms (e.g., Bitcoin and Ethereum), consume substantial amounts of energy. This environmental concern has led to calls for more energy-efficient consensus mechanisms.

Lack of Standardization: The absence of industry-wide standards can hinder interoperability between different blockchain networks. This can create siloed ecosystems and limit the technology’s full potential.

Irreversible Transactions: While immutability is a strength, it can also be a drawback. Mistakes made in transactions, or fraudulent activities, cannot be easily corrected, potentially leading to financial losses.

Complexity: Developing and maintaining blockchain solutions can be complex and resource-intensive. This can be a barrier for smaller businesses or organizations with limited technical expertise.

User Experience: Blockchain wallets and applications can be intimidating and confusing for the average user. Improving the user experience is crucial for mass adoption.

In conclusion, while blockchain technology offers numerous benefits, it is not without its challenges. Its potential to transform industries, enhance security, and streamline processes is compelling. However, addressing issues like scalability, regulation, and energy efficiency will be crucial for realizing blockchain’s full potential in the future. Organizations and individuals should carefully weigh the benefits and drawbacks when considering the adoption of blockchain technology for specific use cases.